Social Security Benefits: Major Changes Effective January 2026

Major changes to Social Security benefits are set to take effect in January 2026, impacting future retirees and beneficiaries. These updates aim to ensure the program’s long-term solvency and adapt to evolving economic and demographic landscapes.

The impending Policy Update: Major Changes to Social Security Benefits Effective January 2026 marks a pivotal moment for millions of Americans. Understanding these modifications is crucial for anyone planning for retirement, currently receiving benefits, or simply concerned about the future of this vital program. This comprehensive guide will delve into the specifics, helping you navigate the implications and prepare for what lies ahead.

Understanding the Context: Why Changes Are Necessary

Social Security, a cornerstone of American financial security for nearly a century, faces ongoing challenges. Demographic shifts, including increased life expectancy and lower birth rates, combined with economic fluctuations, necessitate periodic adjustments to ensure its sustainability. The changes effective January 2026 are a direct response to these pressures, aiming to fortify the program for future generations.

For decades, experts have debated the best strategies to address Social Security’s long-term financial health. These discussions often involve complex actuarial projections and economic forecasts. The current policy updates represent a carefully considered approach to balance the needs of current beneficiaries with the fiscal responsibilities to future ones. It’s not merely about cutting benefits or raising taxes, but about recalibrating a system that serves a diverse and evolving population.

Demographic Shifts and Their Impact

The aging of the baby-boomer generation and declining birth rates mean there are fewer workers contributing per retiree. This shift in the worker-to-beneficiary ratio puts a strain on the pay-as-you-go system. Understanding these underlying demographic trends is key to appreciating the rationale behind the upcoming policy adjustments.

- Increased Life Expectancy: People are living longer, meaning they collect benefits for more years.

- Lower Birth Rates: Fewer new workers are entering the workforce to support the system.

- Retirement of Baby Boomers: A large cohort is moving from contributor to beneficiary status.

These demographic realities create a significant imbalance that, if left unaddressed, could lead to insolvency. The policy changes are designed to mitigate these risks, ensuring that the system can continue to provide essential support. It’s a delicate balancing act that requires thoughtful consideration of various economic and social factors.

The need for these adjustments is not a sudden development but rather the culmination of years of observation and analysis. Policymakers have been monitoring these trends and engaging in discussions to formulate a sustainable path forward. The 2026 changes are a testament to this ongoing effort to adapt Social Security to the realities of the 21st century.

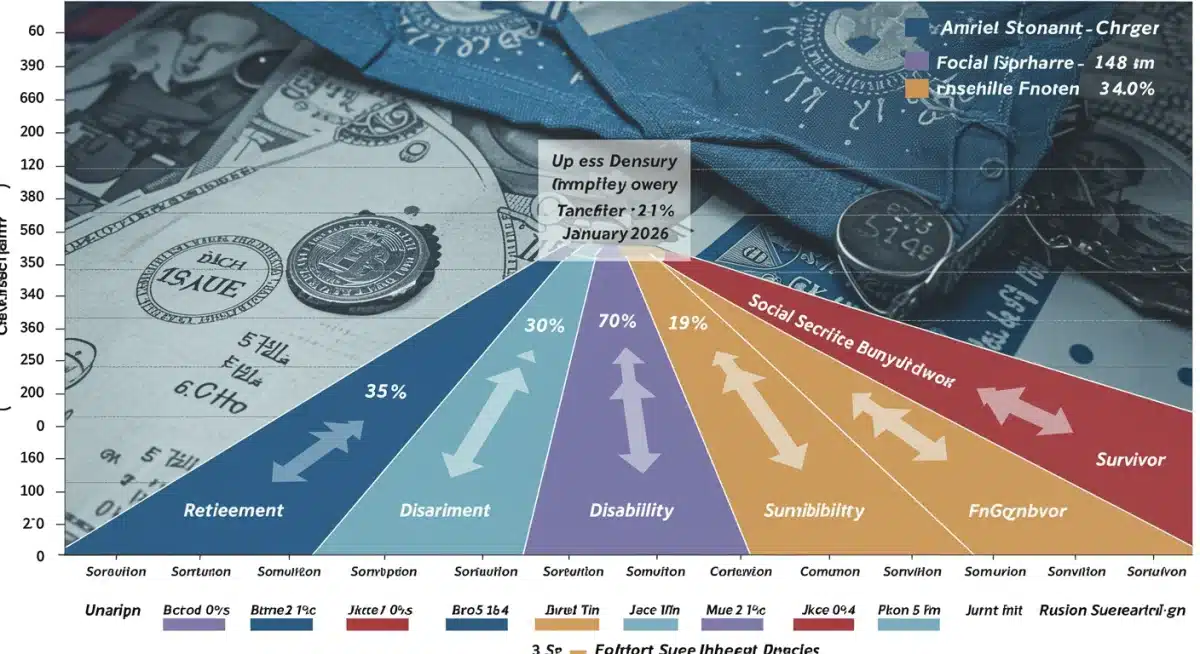

Key Adjustments to Retirement Benefits

One of the most significant aspects of the January 2026 update involves adjustments to retirement benefits. These changes could affect how much you receive, when you can claim, and the calculations used to determine your benefit amount. It’s essential for those nearing retirement, or even those many years away, to understand these modifications to plan effectively.

The changes are not designed to be punitive but rather to ensure the long-term viability of the program. They reflect a recognition that the economic landscape and the needs of retirees have evolved. By understanding the specifics of these adjustments, individuals can make informed decisions about their retirement timelines and financial strategies.

Revised Full Retirement Age (FRA)

The Full Retirement Age (FRA) is a critical factor in determining your Social Security benefits. The new policy may introduce a gradual increase in the FRA for certain age cohorts. This means that individuals born after a specific year might need to work longer to receive their full, unreduced benefits.

- Impact on Future Retirees: Those currently in their 50s and younger are most likely to be affected.

- Benefit Calculation: Claiming before the new FRA could result in permanently reduced benefits.

- Planning Horizon: Individuals should re-evaluate their retirement plans based on the revised FRA.

The decision to adjust the FRA is often controversial, as it directly impacts individuals’ retirement timelines. However, it’s a common strategy employed by pension systems worldwide to adapt to increased life expectancies. The goal is to ensure that the system can continue to pay out benefits for an extended period without becoming insolvent.

Understanding your specific FRA under the new rules is paramount. It will influence not only when you choose to retire but also how you strategize your other retirement savings. Consulting with a financial advisor can provide personalized guidance on how these changes will specifically affect your situation.

Changes Affecting Cost-of-Living Adjustments (COLAs)

Cost-of-Living Adjustments (COLAs) are vital for maintaining the purchasing power of Social Security benefits in the face of inflation. The upcoming policy update may introduce modifications to how COLAs are calculated, potentially impacting the annual increase beneficiaries receive. These changes are often aimed at ensuring the long-term fiscal health of the program while still providing necessary protection against rising costs.

The current COLA calculation method has been a subject of debate for years, with some arguing it doesn’t accurately reflect the spending patterns of seniors. The proposed adjustments aim to refine this process, making it more sustainable and equitable. Understanding these potential shifts is crucial for beneficiaries to anticipate their future income.

New COLA Calculation Methodology

The current COLA is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The 2026 changes might introduce a different index, such as the Consumer Price Index for the Elderly (CPI-E), which often reflects a higher inflation rate for goods and services consumed by seniors.

- Potential for Different Annual Increases: A new index could lead to higher or lower annual adjustments compared to the CPI-W.

- Impact on Fixed Incomes: Beneficiaries relying solely on Social Security will feel the direct effects of any changes.

- Program Solvency: Adjusting the COLA mechanism is also a tool to manage the program’s long-term financial stability.

Any alteration to the COLA calculation is significant because it directly affects the real value of benefits over time. Even small percentage differences can accumulate into substantial amounts over a retiree’s lifespan. Therefore, staying informed about the specifics of the new methodology is essential for financial planning.

The goal of recalibrating COLAs is to strike a balance between providing adequate financial support to beneficiaries and ensuring the program’s ability to meet its obligations. It’s a complex economic decision with broad implications for millions of Americans, highlighting the importance of understanding the details before January 2026.

Impact on Disability and Survivor Benefits

While much of the focus often centers on retirement benefits, the Policy Update: Major Changes to Social Security Benefits Effective January 2026 also extends to disability and survivor benefits. These crucial components of Social Security provide a safety net for individuals facing unforeseen circumstances, and any alterations will have significant implications for vulnerable populations.

The changes to disability and survivor benefits are often less publicized but are equally important. They reflect an effort to ensure fairness, efficiency, and sustainability across all facets of the Social Security program. Understanding these nuances is critical for those who rely on or may one day need these forms of assistance.

Eligibility Criteria and Benefit Amounts

The upcoming changes could involve revisions to the eligibility criteria for disability benefits, potentially affecting how medical conditions are assessed or the work history required. Similarly, survivor benefits might see adjustments in how they are calculated or distributed among eligible family members.

- Disability Claims Process: Potential streamlining or stricter requirements for approval.

- Survivor Benefit Calculations: Modifications to how spousal and children’s benefits are determined.

- Review Processes: Enhanced reviews for continued eligibility for existing beneficiaries.

These adjustments are often implemented to prevent fraud, ensure that benefits go to those genuinely in need, and manage the overall financial health of the trust funds. While changes can be challenging for applicants and beneficiaries, they are typically aimed at improving the long-term integrity of the system.

It is advisable for individuals who currently receive or anticipate needing disability or survivor benefits to review the updated guidelines as soon as they are fully released. This proactive approach will help ensure compliance and understanding of any new requirements or benefit structures that come into effect in January 2026.

Navigating the New Landscape: Planning and Preparation

With the Policy Update: Major Changes to Social Security Benefits Effective January 2026 on the horizon, proactive planning and preparation are more important than ever. These changes are not just abstract policy shifts; they have tangible implications for individual financial futures. Understanding how to adapt is key to maintaining financial stability and achieving retirement goals.

Successful navigation of these changes requires a multi-faceted approach, combining personal financial assessment with informed decision-making. It’s an opportunity to review existing plans, seek expert advice, and make necessary adjustments to ensure a secure financial future.

Personal Financial Assessment

Start by evaluating your current financial situation, including savings, investments, and other income sources. Project how the new Social Security rules might affect your expected benefits and identify any potential shortfalls. This assessment forms the foundation of your revised financial strategy.

- Review Current Savings: Assess if your retirement savings are sufficient under the new benefit projections.

- Re-evaluate Retirement Age: Consider if you need to adjust your planned retirement date.

- Explore Alternative Income Streams: Look into additional sources of income to supplement Social Security.

Understanding your personal financial landscape in light of the upcoming changes empowers you to make informed decisions. It helps in identifying areas where you might need to save more, work longer, or explore different investment strategies. The sooner you begin this assessment, the more time you’ll have to implement any necessary adjustments.

This proactive approach ensures that you are not caught off guard by the changes but rather are well-positioned to adapt. Financial planning is an ongoing process, and these policy updates serve as a critical juncture for re-evaluation and recalibration.

Resources and Support for Beneficiaries

As the Policy Update: Major Changes to Social Security Benefits Effective January 2026 approaches, access to reliable information and support will be invaluable. The Social Security Administration (SSA) and other reputable organizations will be key resources for beneficiaries seeking clarity and guidance. Staying informed through official channels is paramount to understanding the specifics of these complex changes.

Navigating the intricacies of Social Security can be daunting, even without major policy shifts. Therefore, knowing where to turn for accurate information and personalized advice can make a significant difference. These resources are designed to help individuals understand their rights, responsibilities, and options under the new rules.

Official Sources and Expert Advice

The Social Security Administration’s official website is the primary source for factual information regarding policy changes. Additionally, consulting with certified financial planners or benefits specialists can provide tailored advice based on your individual circumstances.

- SSA Website: Regularly check for official announcements, FAQs, and updated benefit calculators.

- Financial Advisors: Seek professional guidance to understand personal impacts and adjust financial plans.

- Community Workshops: Attend informational sessions offered by local senior centers or advocacy groups.

Relying on official and expert sources is crucial to avoid misinformation. Social Security policies are complex, and accurate interpretation requires careful attention to detail. These resources are there to demystify the changes and help you plan effectively.

Remember, you don’t have to navigate these changes alone. A wealth of information and professional support is available to help you understand the implications of the January 2026 updates and ensure your financial well-being remains secure.

| Key Change | Brief Description |

|---|---|

| Full Retirement Age (FRA) | Potential gradual increase for specific birth cohorts, affecting when full benefits can be claimed. |

| COLA Calculation | Possible shift to a new inflation index (e.g., CPI-E) impacting annual benefit increases. |

| Disability & Survivor Eligibility | Revisions to criteria and benefit calculation methods for disability and survivor benefits. |

| Long-Term Solvency | Overarching goal of changes is to strengthen the financial stability of the Social Security program. |

Frequently Asked Questions About 2026 Social Security Changes

Individuals born after a specific year, typically those currently in their 50s and younger, are most likely to see their Full Retirement Age gradually increase. It’s crucial to check the SSA’s official guidelines based on your birth year to understand your specific FRA.

A shift to a different inflation index, such as the CPI-E, could result in varying annual cost-of-living adjustments. This could lead to slightly higher or lower increases each year compared to the current CPI-W method, directly affecting your purchasing power.

The policy update may introduce revised eligibility criteria or a more streamlined review process for disability claims. While the aim is efficiency and fairness, some changes could potentially make the application process more rigorous or require more extensive documentation.

It’s advisable to review your personal financial plan, assess your expected benefits under the new rules, and consider consulting a financial advisor. Staying informed through the official Social Security Administration website is also crucial for accurate information.

The primary goal of the 2026 policy updates is to ensure the long-term solvency and sustainability of the Social Security program. While some adjustments may affect benefit calculations or eligibility for certain groups, the overall aim is to strengthen the system for future generations, not simply to cut benefits across the board.

Conclusion

The Policy Update: Major Changes to Social Security Benefits Effective January 2026 represents a critical juncture for the foundational American social insurance program. These adjustments, driven by demographic shifts and economic realities, are designed to ensure the program’s vitality for decades to come. While the specifics of these changes may necessitate a review of personal financial strategies, they underscore a commitment to maintaining Social Security as a reliable pillar of support. By staying informed, utilizing available resources, and proactively planning, individuals can navigate this evolving landscape with confidence, securing their financial future and that of their loved ones. The journey to 2026 offers an opportunity for all Americans to engage with these vital discussions and prepare for the future of Social Security.